This post is part of our series on diversification and asset allocation. Previously:

The Permanent Portfolio - an equal weighted allocation to stocks, bonds, gold, and cash - was devised by free-market investment analyst, Harry Browne, in the 1980s. The basic idea is that no matter what the macro environment, the portfolio will not totally crash and burn.

The American Experience

Turns out, the theory largely worked for US investors.

If you look at the rolling 3-year annualized returns of the Permanent Portfolio, never has it given negative returns. In sharp contrast to equities and gold, US bonds have been spectacularly stable. So naturally, an equal weighted allocation to all for assets delivered decent returns with low drawdowns.

Did it work for Indian Investors?

Indian investors need to be careful with their bond allocations.

The Permanent Portfolio allocates 50% towards fixed income. This is a problem for Indian investors because unlike US bonds, Indian bonds do not have a “flight to safety” bid - they tank along with stocks during market panics.

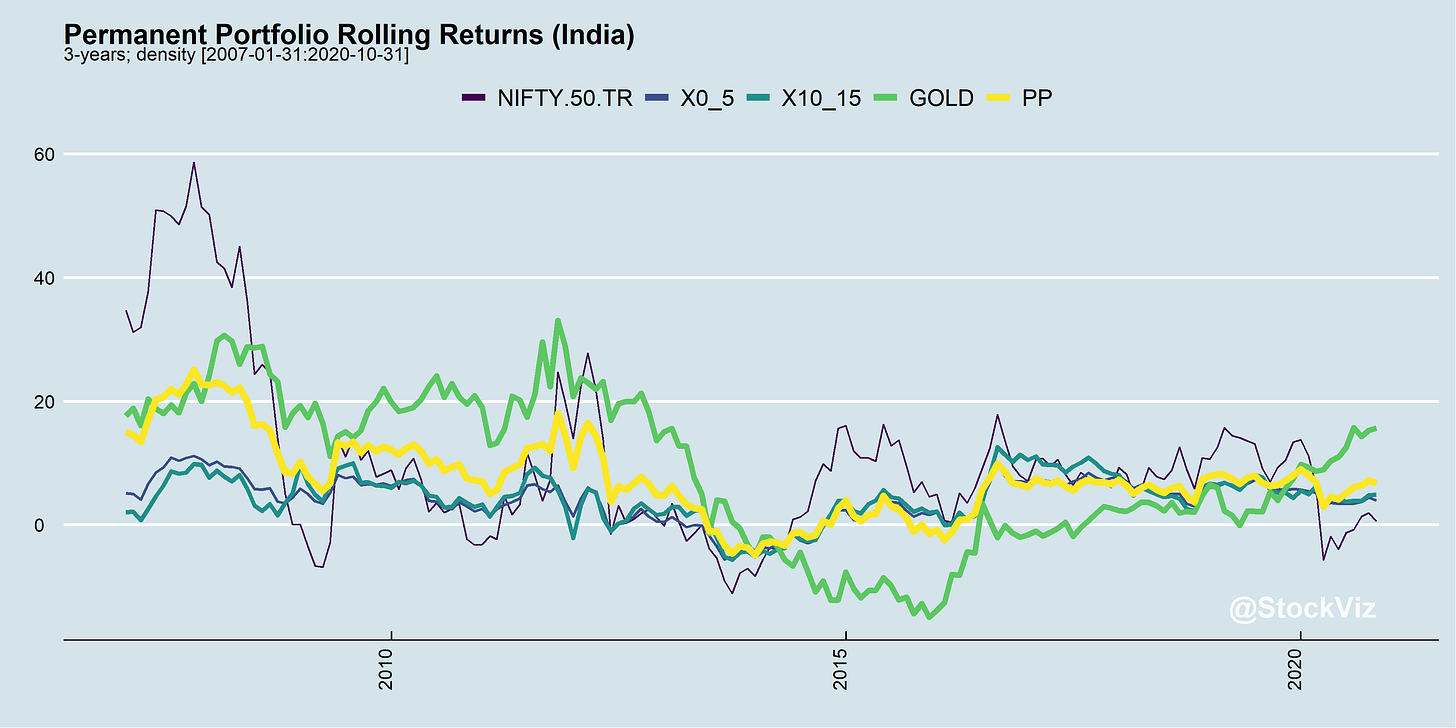

A density plot of annualized 3-year rolling returns highlights the left-tail problem with the Indian Permanent Portfolio:

Take-away

Beware of people preaching simple solutions to complex problems. If the answer was easy someone more intelligent would have thought of it a long time ago – complex problems invariably require complex and difficult solutions. - Steve Herbert

This is another instance of a “copy-paste” solution disappointing Indian investors.

The common thread connecting the misfiring of the 60/40 and the Permanent portfolios is the vastly different paths taken by Indian bonds. Is there a better way to crack this nut? Stay tuned.