Decoding the 60/40 Portfolio

Get onboard with the embedded assumptions before diving head-first.

The 60/40 allocation - 60% in equities, 40% in bonds - is the bedrock on which most portfolios in the US are built. Jack Bogle was its biggest proponent and it serves as a benchmark in most portfolio discussions.

This post is part of our series on diversification and asset allocation. Previously:

Historical Performance

From a cumulative performance point of view, it is easy to see why it is attractive.

Even with an annual rebalance, the 60/40 delivered. How did it achieve this remarkable feat? Should investors expect similar magic with the same allocation to Indian equities/bonds?

The biggest difference: Volatility

Ever since Volcker got done slaying inflation in the 80’s, US bond yields have been on a secular decline with declining volatility and increasingly occupying the place of a “flight-to-safety” asset.

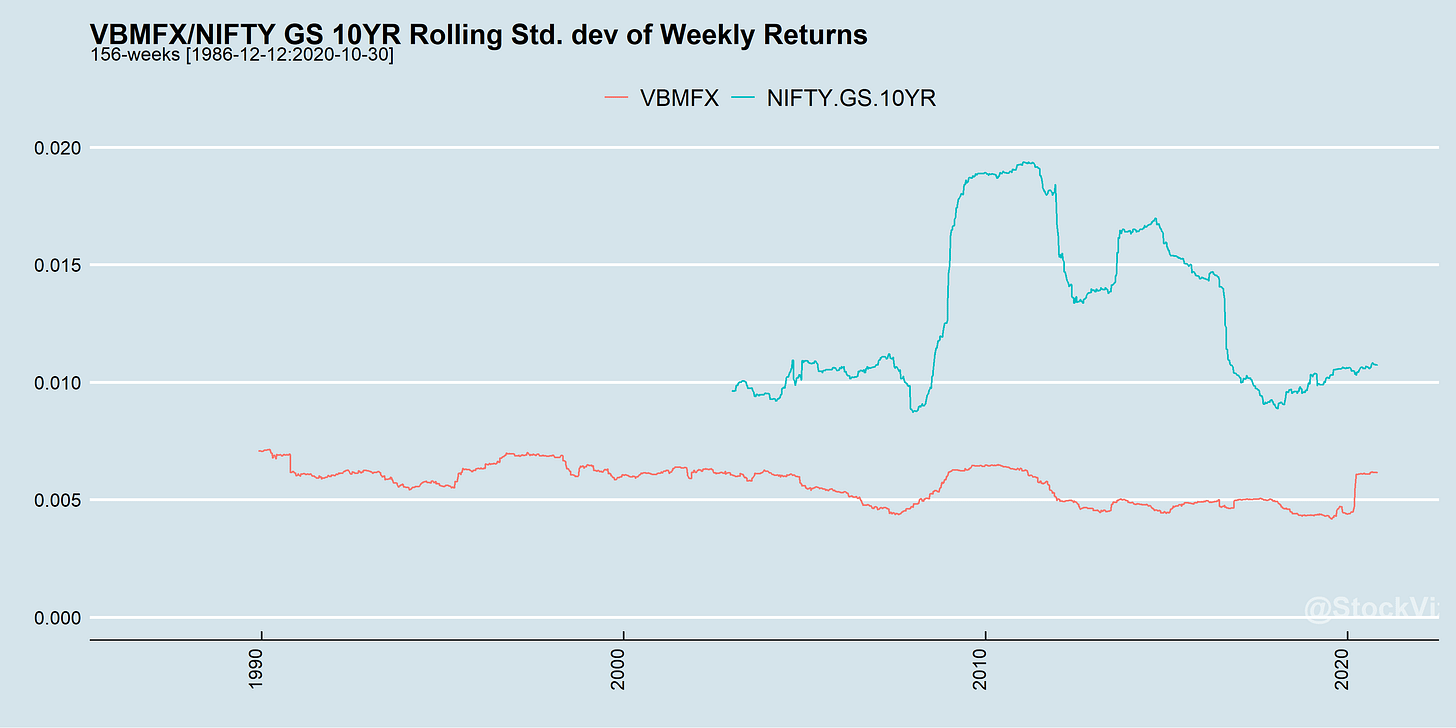

Indian bonds, however, are in no way comparable to US bonds when it comes to volatility.

Volatility of US Bond returns (3-year, rolling) with those of Indian Gilts:

On a cumulative basis, Indian bond investors have taken a lot of pain for a 50bps out-performance.

Indian bonds haven’t exactly acted as a safe-haven in times of stress for Indian investors. Adding equities into the mix brings out the extreme volatility of Indian stocks:

However, the silver-lining is that Indian asset volatility have been moderating since 2015.

The 60/40

Over a long enough timeline, it looks like the 60/40 should work in India as well.

But, what if, most of the long-term returns that can be seen since 2000 was front-loaded? Rolling-returns over different windows should give us an idea:

The 5-year window shows returns stabilizing around an average of 5% (in USD.)

Embedded forecasts

All investing is forecasting. As much as one would want to follow a 60/40 allocation for its popularity, it behooves to ask: what are the embedded forecasts about Indian equities and bonds in such a strategy?

Bond volatility will continue to go down.

The market will continue to deepen.

Inflation will be range-bound.

Equities will be loosely efficient.

The gap between growth assumptions and equity valuations will be within a gradually tightening band.

Ease of doing business:

Contract enforcement

Flexible labor laws

Infrastructure

Bankruptcy protection and resolution

Policy stability

Basically, India will move towards an environment with a predictable tax regime, a rules-based fiscal policy, and regulations that are fair and strictly enforced.

Take-away

There are millions of permutations and combinations of securities for investors to allocate. The question that every investor should ask themselves is how much time, effort and money they are willing to spend chasing returns that beats low-cost, set-it-and-forget-it strategies like the 60/40.

If you are in investor who craves simplicity & low-cost and your beliefs about the future is mostly in line with the assumptions presented above, then this is the strategy for you.