Volatility is how rapidly an investment tends to change in price. Risk is the potential permanent loss of money.

This is a continuation of our earlier post: Embracing Volatility

Volatility measures changes in price. Price is a measure of sentiment. Volatility measures changes in sentiment.

Most of the time, it is impossible to tell the difference between the two.

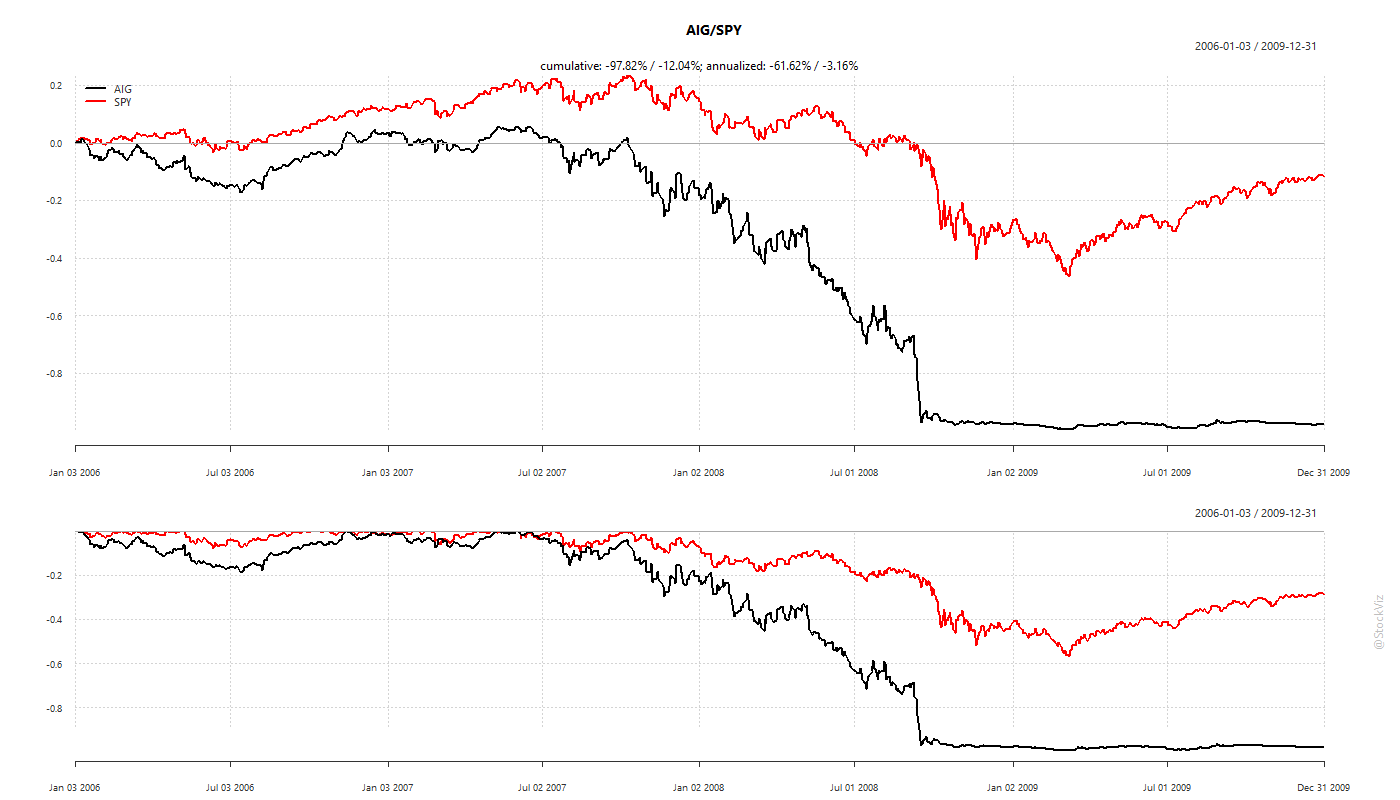

Exhibit A: AIG

American International Group, AIG, had enjoyed a AAA rating for 22 years and had been just one of eight US companies to hold the top rating from both S&P and Moody's.

As mortgages started to go bad, AIG stock began its long journey to zero from July 2007. During that time, a majority of investors thought that every dip was a buying opportunity.

The problem with trying to be too smart about “volatility” vs. “risk” is how do you know what is priced-in vs. what is panic-selling?

If you are going to panic, panic early!

Panic is good only if you panic early, and as a trader the first thing you learn is to panic early. - Nassim Taleb

Discretionary investors wax eloquent about the strength of their conviction. Having done their homework, they claim, they have the “diamond hands” to hold onto their investments during bouts of volatility and to buy the dip.

However, these narratives are heavily driven by survivorship bias. You will never hear about conviction and diamond hands from investors who bought the dip in Bear Stearns, Suzlon or Kingfisher Airlines.

As an investor, you get no points for being a hero. If there is a whiff of something unpleasant, it is better to get out of an investment entirely, take a beat, re-evaluate, do a relative-value assessment to figure out how it compares to other opportunities and only then decide whether you want add it back to your portfolio.

Exit first. Ask questions later.

Compounding works both ways

Losers average losers - Paul Tudor Jones

We have all seen the Whatsapp forward about compounding: (1 + 0.1)^10 = 2.59 i.e., 10% compounded over 10 years will turn every rupee into 2.59 rupees. Rarely do you see the reverse: a 50% loss requires a 100% return to get back to even.

If you care about compounding your portfolio, stop compounding your losses!

Investing is risk management

… and risk management is not free.

Most investors focus on the glamor part of the process: scuttlebutt stock-picking to find the rare “hidden” gem that will 100x in 5 years. They would have better odds buying lottery tickets instead.

There are plenty of investors who became millionaires simply by grinding away at harvesting risk premia and managing risk.

Avoid blowing yourself up and allow statistics to do play out.

Risk Management Is Not Free: Part I, II, III

Diversify and Rebalance

The only investors who shouldn’t diversify are those who are right 100% of the time. - Sir John Templeton

There is a big difference between the advice professional investors give to other professional investors (like the ones above) and the advice that savers need to follow. The media often focuses on the former because it is exciting and there’s always something new whereas the later is mostly timeless and boring.

The media’s sampling and survivorship bias ensures that only large, successful, telegenic professional investors get the spotlight. And media’s short attention span ensures that most of them are never held to account for their pontifications. As far as the media is concerned, the only crime is to be boring.

The tragedy is that there are only so many ways in which you reframe “save into a diversified portfolio by dollar cost averaging into a low-cost, broad-based equity fund and a short-term bond fund.” So it is guaranteed to never get the airtime in proportion to how important it is.

Diversification means that your incremental dollar is buying the asset that has not appreciated as much as the other. For example, if you keep a static 50/50 equity/bond portfolio and equities are up 10% but bonds are up 2% then the next dollar you put into that portfolio is going to buy more of the bonds and less of equities. This is where the Risk Management is Not Free rule kicks in: diversification is anti-momentum, a premier market anomaly. By diversifying and rebalancing, you are not maximizing your portfolio returns but minimizing volatility in a cost-effective way.

Remember, that in the end, we are all short volatility.

Looking for a sensible way to invest? Here’s how to get started.

Did you know that the following recording can be watched at 2x speed and is often hilarious?