In the short run, market is a voting machine; in the long run, it's a weighing machine. - Benjamin Graham

Price is a measure of Sentiment

Early last year, when it became clear that the China Virus had spread all over the world and was getting millions sick, overwhelming healthcare systems everywhere, the markets tanked. In USD terms, Indian stocks were down more than 40% and the S&P was down more than 30%.

Then, a miracle cure was discovered and the markets quickly recovered.

Just kidding!

Governments and Central Banks everywhere did whatever they could to lift sentiment. And markets quickly followed.

Sentiment remains one of the least understood but the most important factor in investing. All prices are eventually tied to how optimistic or pessimistic investors are feeling about the future.

While Graham’s weighing machine might arrive in time for tenured investments, like bonds, that have a fixed maturity date, perpetual securities like stocks are always at the mercy of the voting machine, i.e., sentiment.

The Market sets the Price

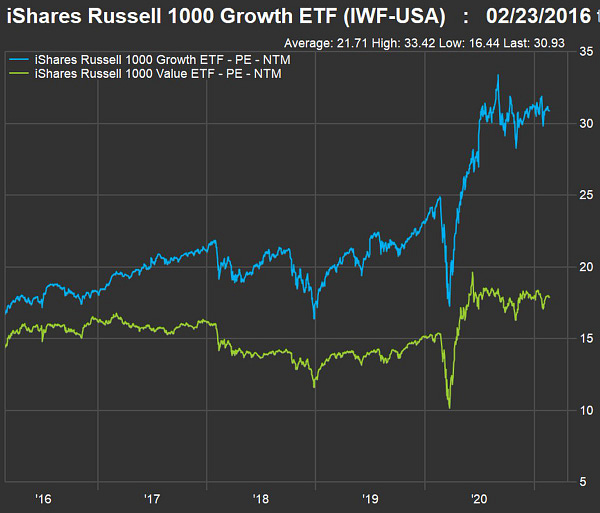

For stocks, Price = multiple x earnings

For prices to go up, you don’t need earnings to go up. It is enough if multiples do.

The market doesn’t care why you are transacting. Only that you are. It doesn’t matter what your investment horizon is or the type of investor you are, all transactions take place in the market at a price set by it.

As an investor, you can be right about the company (direction of earnings) but wrong about the sentiment (direction of multiple) and can end up with a stock that goes nowhere in price for years and exit with no rewards for your effort.

No such thing as Buy-and-Hold Forever

It is the end of a "long-term" for a subset of investors everyday.

Investors usually save with a specific goal in mind. These goals tend to be time bound: retirement, kid’s education, etc. While their horizons can be “long” at the outset, it gradually shortens as the D-day arrives. Equities (and other high-risk securities) are constantly being sold and rotated into bonds (and other low-risk securities) set by a glide-path.

As much as professionals like to fantasize about long-term investing, the investors in their funds have bounded horizons. This is especially true for open-end funds.

Sentiment + Finite Holding Periods = Volatility

Finite holding periods create the need to transact. This makes it impossible to ignore sentiment. The two combine to create volatility.

It is easy to blame investor greed and fear for bad portfolio outcomes. We have all seen this sketch make the rounds:

However, even if an investor overcomes the call of greed and fear, it is impossible to ignore time. This makes sentiment the prime determinant of investment outcomes.

If you think investors having longer time-horizons can ignore volatility. Think again. As the chart above illustrates, volatility is an equal opportunity hater.

Embrace and Extinguish

Volatility clusters. You have reasonably long periods of calm, then suddenly a lot of things “go wrong.” Markets gyrate and you feel that all hell has broken lose.

This leads investors to assume that periods of calm are normal and volatility is abnormal. But in markets, the reverse is true. Sudden shocks, volatility and jolts to sentiment are the norm. Calm periods are the anomaly.

Sentiments wax-and-wane. Multiples expand and contract. Markets melt-up and melt-down for no good reason.

The only time-tested way of reducing volatility is asset allocation. Invest in a basket of different assets (make sure that at least a few of them a not financialized) and accept the market for what it is.

Embrace volatility and extinguish it.

Looking for a sensible way to invest? Here’s how to get started.