SPAC Me!

Who wouldn't like a blank cheque company?

The world changed last year in many ways, one of the ways markets changed is the way companies chose to go public.

For the longest time, a company that wanted to go public, would do it through an IPO, which is a tedious and rigorous process involving many steps and multiple parties from the company, investment bankers, underwriters, the regulator, institutional and retail investors.

However last year, many startups chose to go public via a new routes via SPACs, which is when a startup merges with an existing publicly listed company founded for the sole purpose of acquiring a company like theirs and taking it public in a less cumbersome way.

A SPAC (Special Purpose Acquisition Company,) issues shares at $10 to retail and institutional investors and these investors hop in with the hope that the target acquisition will be a successful one and the $10 issue multiples by many times.

SPACs have been launched by Bill Ackman- the star hedge fund manager, Softbank Shaquille O’Neal and of course Chamath Palihapitiya who is perhaps the poster child for this frenzy.

And many well-known companies such as Virgin Galactic, OpenDoor and Draftkings have chosen this route to go public.

The Frenzy

So why is this a bad thing?

Legendary investors such as Sam Zell, Charlie Munger and others have come out and called it a bubble, questioning the motives involved and have even come close to calling many of these deals as a fraud.

Take the example of Nikola, an alternative fuel vehicle manufacturer that went public through a SPAC, was later on to be found as a fraud by independent researchers to the extent that the company faked a promo video of one of their prototype truck which was actually rolling down a hill instead of moving on its own.

There have been other accusations or fraud misleading investors in other SPACs such as Clover Health.

And this brings us to one of the main criticism of SPACs. An IPO process is thorough involving due-diligence and vetting by many parties involved and the company makes various disclosures to the general public which reveal various risks or missteps by the company. It was this process that torpedoed WeWork’s IPO.

Like for example, the accusation against Clover Health is that it did not disclose a pending US Department of Justice (DOJ) investigation when it went public which would have been revealed if had chosen the traditional IPO process.

The rigorous IPO process has come to become rigorous through time in order to protect investors and general public from companies misleading the public and artificially inflating their values. The SPAC process seems to undermine that.

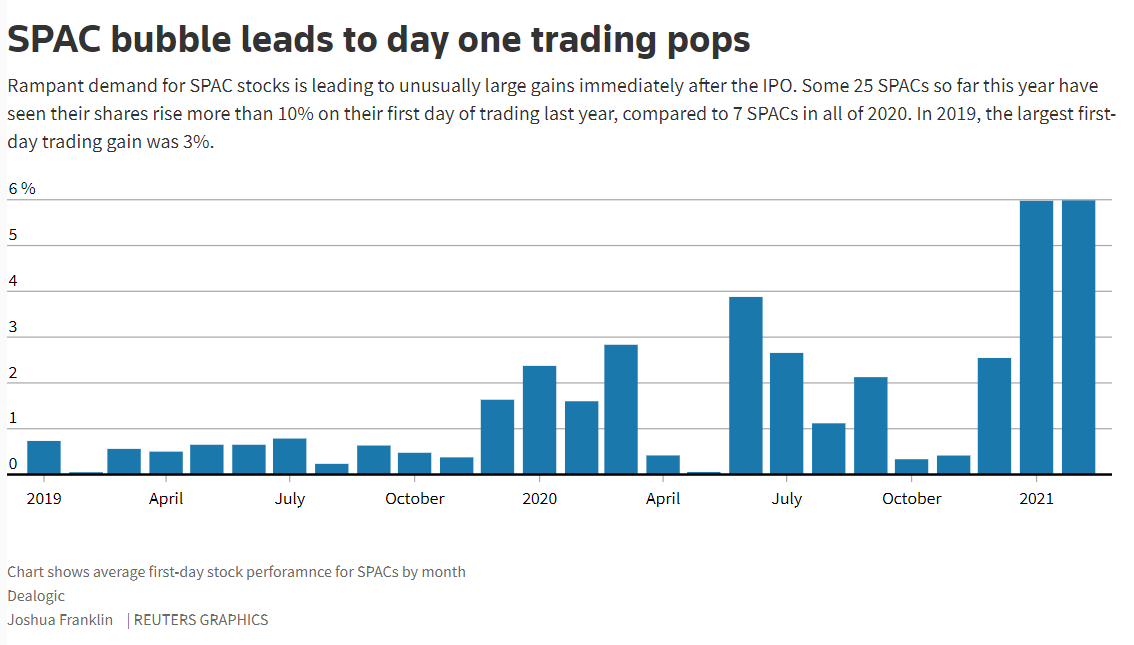

The other main criticism is that in many offerings the SPAC sponsor, the target company, the initial investors in the SPAC are all interested in the initial pop or making a quick buck by hoping onto the latest trend such as space, EV, healthcare, biotech, digital and whatever else is hot. When the bubble pops, a lot of investors will lose lot of of money.

In-fact you don’t even have to wait for the bubble to pop, most mergers most SPACs post-mergers have fallen.

Source: Harvard Law

Early liquidity removes incentives

Let’s say you are an employee of a startup where a large portion of your pay is in the form of stock options and RSUs (Restricted Stock Units.) The firm does a premature IPO (before Product-Market Fit, pre-revenue, etc.) and the stock goes to the moon. Its now in your best interest to sell as you vest and rest. What incentive do you have to slog further when you know that the market has already paid you for the next decade of work?

So if the bubble pops, will it bring down the market?

In 2020 and 2021, over $90 billion has been raised via SPACs and it’s very likely that SPACs will continue to gain traction and grow more popular. However, it’s a very small fraction of the market and even if this bubble pops, the overall market will be largely unaffected.

It’s more likely that a significant market downturn will pop this bubble and many others in its course.

Check out completely automated direct-equity advisory: freefloat.in

Investing in the US? We got you covered on freefloat.us

The accompanying video was great. The historical background, including reverse mergers, etc. was good to know about. But why are we patronizing retail investors here? It's their money, and they can buy whatever they want - no?