Quality - The Rational Factor

It makes sense right that better quality companies should get a higher valuation but what does it mean exactly.

“Quality : the standard of something as measured against other things of a similar kind; the degree of excellence of something.” - Definition of Quality

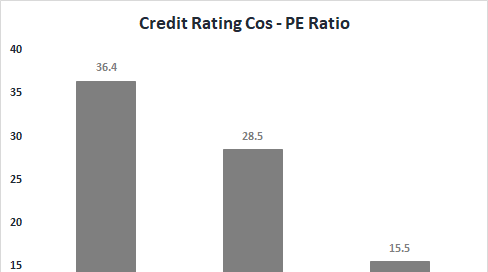

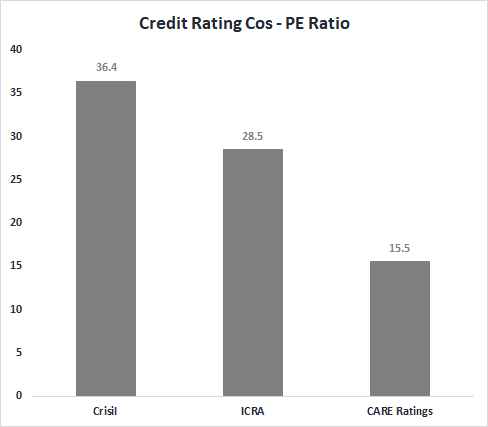

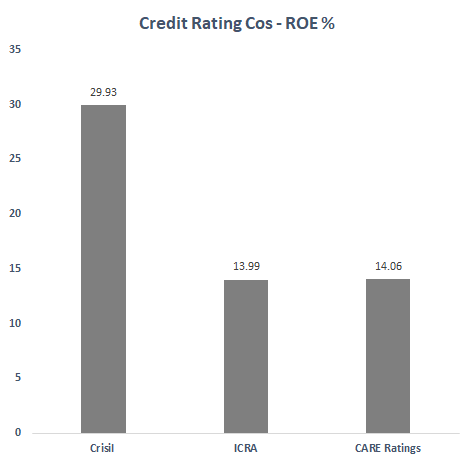

Let’s start with credit rating companies, that are agencies that rate debt instruments of companies and governments.

CRISIL by far is the leader, commanding a much higher premium in it’s valuation compared to its peers.

Here is why

Return on Equity (ROE) reflects the different companies profitability margins, pricing power and other competitive advantages including intangibles such as brand credibility that CRISIL has over its peers.

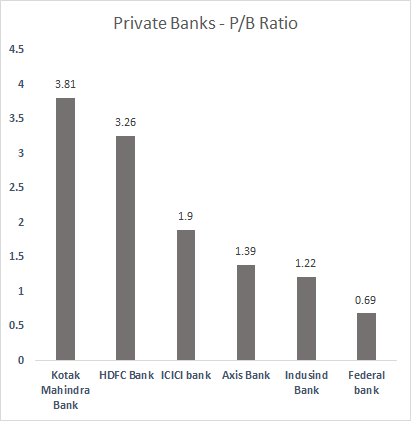

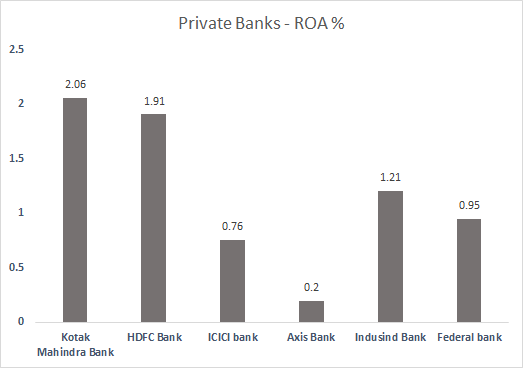

Let’s look at another sector - Private Banks

There is a big difference in how these banks are valued and just like the credit rating companies, the reason remains same.

Return on Assets (ROA) for a bank reflects the difference in the interest it lends (loans) and borrows (deposits), contribution from fee and treasury income and level of bad assets. This one number perhaps best represents all the choices the management makes over a period of time and is a good indicator of quality of it.

It’s also interesting that both credit rating companies and banks offer essentially the same products and services and branding makes little difference but the difference is in how they are run.

But what is Quality in investing really

I like to think of quality in investing to be predictability in earnings, high profitability margins, low debt and low risks emanating from macroeconomic factors. Think Apple.

The problem with quality as we have seen is that they tend to be richly valued, where not only future growth prospects but the value of ‘quality’ reflected in it’s premium valuation.

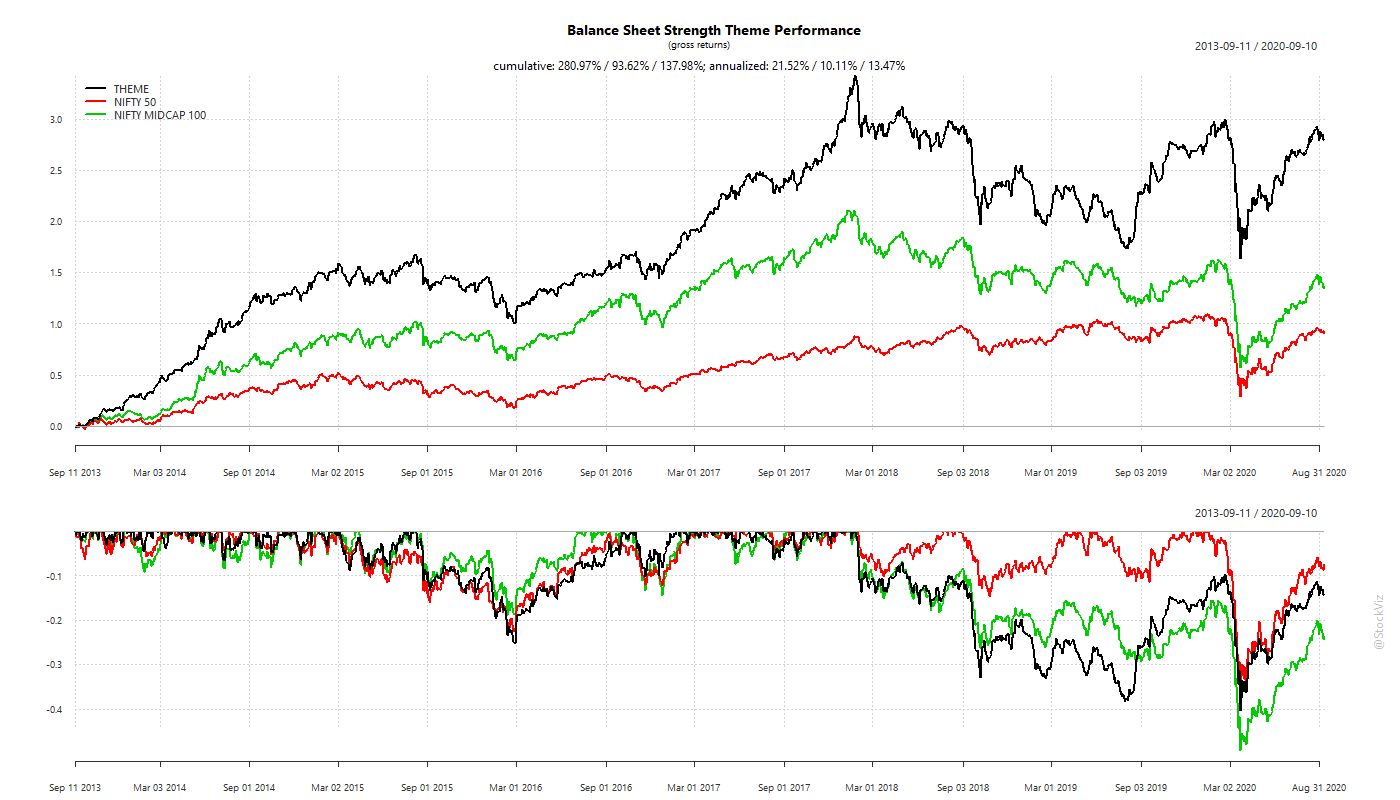

So can Quality portfolio outperform the broader markets?

Stockviz’s proprietary Quality Factor does outperform Nifty and Midcap Portfolios by a wide margin.

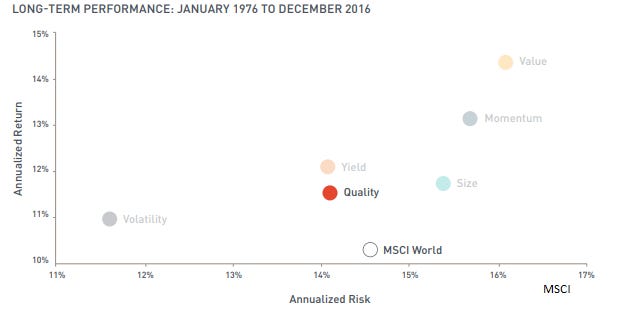

Let’s look at more evidence

If you compare it with MSCI data, quality does not really outperform value or momentum but is less volatile and risky.

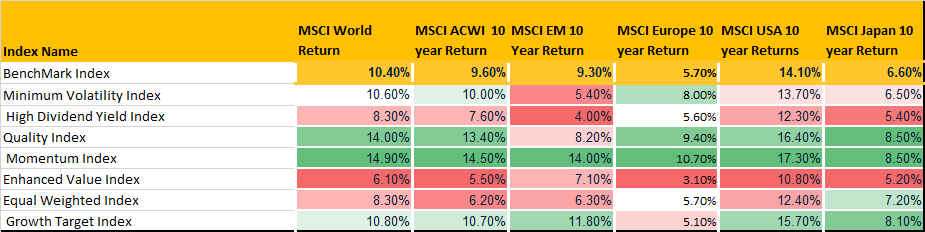

But let’s dig deeper and you’ll find that Quality has not under-performed across the different world markets in the last 10 years, it’s been on par with the

Source: MSCI

Limitations

In India, the quality names such as HUL, NESTLE, Dabur are extremely overvalued? Can those stocks really outperform in the next 10 years?

Also most factor strategies tell you to ignore financials, when financials constitute like 30% of the index is it really possible to do so?

We’talk about this in more detail next time round.

For now, enjoy the discussion: