Define: Momentum “the strength or force that something has when it is moving: the strength or force that allows something to continue or to grow stronger or faster as time passes.”

In Investing, “ Momentum is the phenomenon that securities which have performed well relative to peers (winners) on average continue to outperform, and securities that have performed relatively poorly (losers) tend to continue to underperform”

Momentum Factor is perhaps the most well-known, not in a technical way, but you can imagine someone on TV with no knowledge of Factors talking about a stock moving up because of Momentum.

Momentum Factor strategies have grown a lot in popularity. I think on Smallcase, it’s the most common strategy. Shyam and I both have a lot of strategies based on Momentum.

And there is a reason for it, it’s easy to implement, and there are many ways to implement it. For example, a refined universe, some twists and filters, and you have an edge.

Like even a fundamental-oriented analyst or investor can have a universe of 100 high conviction stocks and use Momentum to choose the top 20 to get the timing right. To ensure she’s not stuck in a value trap or underperforming the markets significantly, Momentum can help you with that.

And the last year has been good. Momentum has outperformed other factors and is clearly the winner right now.

So does this mean that Momentum is the way to go?

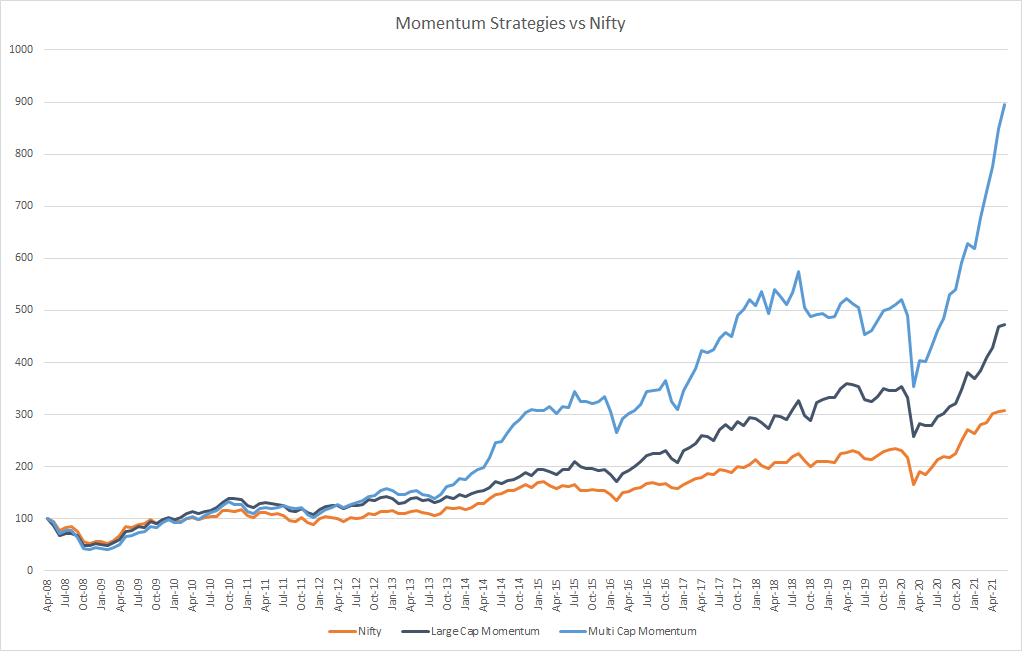

Momentum does well in a bull market. Like the definition of Momentum goes, once Nifty gets going, momentum strategies act as that extra force that allows your portfolio to gallop.

Also, momentum strategies are highly correlated to Nifty, between 0.85-0.92 (1 means perfectly correlated). It’s the overall direction of the market that determines how overall Momentum does.

Momentum can have years of drawdowns. In the last 13 years, our multi-cap momentum strategy has spent 7-8 years underwater, which is the majority of the time.

There have been multiple periods where the strategy has been down for consecutive years. That can be hard for anyone to hold onto a model without certainty that the strategy will recover. Like there is no reason why recovery cannot take 5 years. So will you hold onto a strategy only because a model shows persistent outperformance in the past?

Momentum, especially small-cap and midcap-oriented strategies, are highly vulnerable to sharper corrections. In all significant corrections in the last 13 years, the multi-cap momentum strategy, which consists of midcap stocks, has fallen more than Nifty and Large-cap Momentum strategies.

And my guess is that, since more funds have gone to momentum strategies in the last few years, it’s likely that the falls will get sharper as there will be a stampede to get out.

The more popular it becomes, the smaller the edge will be. It’s almost a fact in the investment world, but systematic strategies have a shelf life. Systematic strategies exist because there is a market anomaly, a market inefficiency that allows portfolio managers or individuals to earn alpha.

Momentum Factors have been had a long persistent period of outperformance not just in India but globally. Value was the most well-known factor. It made Warren Buffet and 100s of investors not only famous but really wealthy.

However, it got prevalent. And that factor has done underperformed S&P 500 and other Factors in the last decade. Will momentum have a similar fate?

However, If you are serious about Momentum.

These are risks that you need to withstand and try to mitigate some of them. We’ll go in-depth next or the week after about some ideas of how to tailor momentum strategies to be within your comfort zone.

Subscribe to our momentum strategy, the All Star Portfolio, here: freefloat/all-star