Is it rational to be irrational?

Not losing is winning.

“Take the probability of loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we're trying to do.” - Charlie Munger

In 2002, Daniel Kahneman won the Nobel prize in economics for his groundbreaking work in applying psychological insights to economic theory, particularly in the areas of judgment and decision-making under uncertainty. In 2017, the Nobel prize in economics went to his long-time collaborator, Richard Thaler, for exploring the biases and cognitive shortcuts that affect how people absorb and process information. Their books, Nudge, Misbehaving, Thinking, Fast and Slow, went on to become best sellers and hugely influential.

When it comes to investing, their biggest observation is that people prefer to avoid losing compared to gaining the equivalent amount.

This leads to poor investment outcomes because investors use their “lizard brain,” ignoring probabilities and expected returns.

Context matters

Imagine, you are asked to spend a month in a deserted island that has no food. You are allowed to fill a sack with anything you want and take it with you. What will you fill it with?

The “rational” answer is potatoes. It is one of the most nutritious vegetables known to us. It is a good source of many vitamins and minerals, such as potassium and vitamin C. Aside from being high in water when fresh, potatoes are primarily composed of carbs and contain moderate amounts of protein and fiber. (Potatoes 101)

Now, what if you are allowed to take 7 sacks? A normal person would probably still fill one sack with potatoes but go on to fill the other 6 with different types of food. After all, who, in their right mind, would like to eat potatoes every day for 30 days? Economists, however, would label this person “irrational” because he did not take 7 full sacks of potatoes with him.

Rationality is context dependent. By viewing all decisions from within a context-independent model, an economist might arrive at the conclusion that people are irrational. But, so what?

Prospect in Theory but not Prosperous in Practice

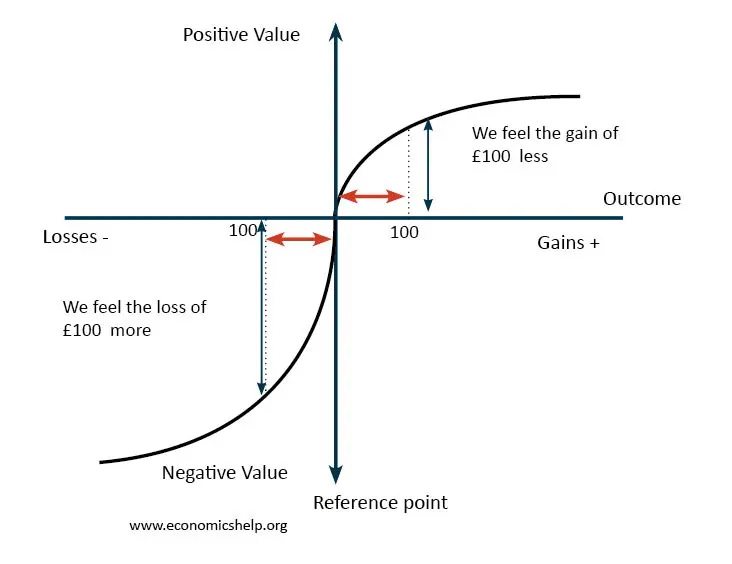

Prospect theory, summarized in the chart above, simply states that carriers of value are changes in wealth or welfare – rather than final outcomes. In theory, a smart investor should be able to exploit this irrationality, along with a million other behavioral weaknesses, and make bank. But in practice, the theory has been a bit of a let down in that area.

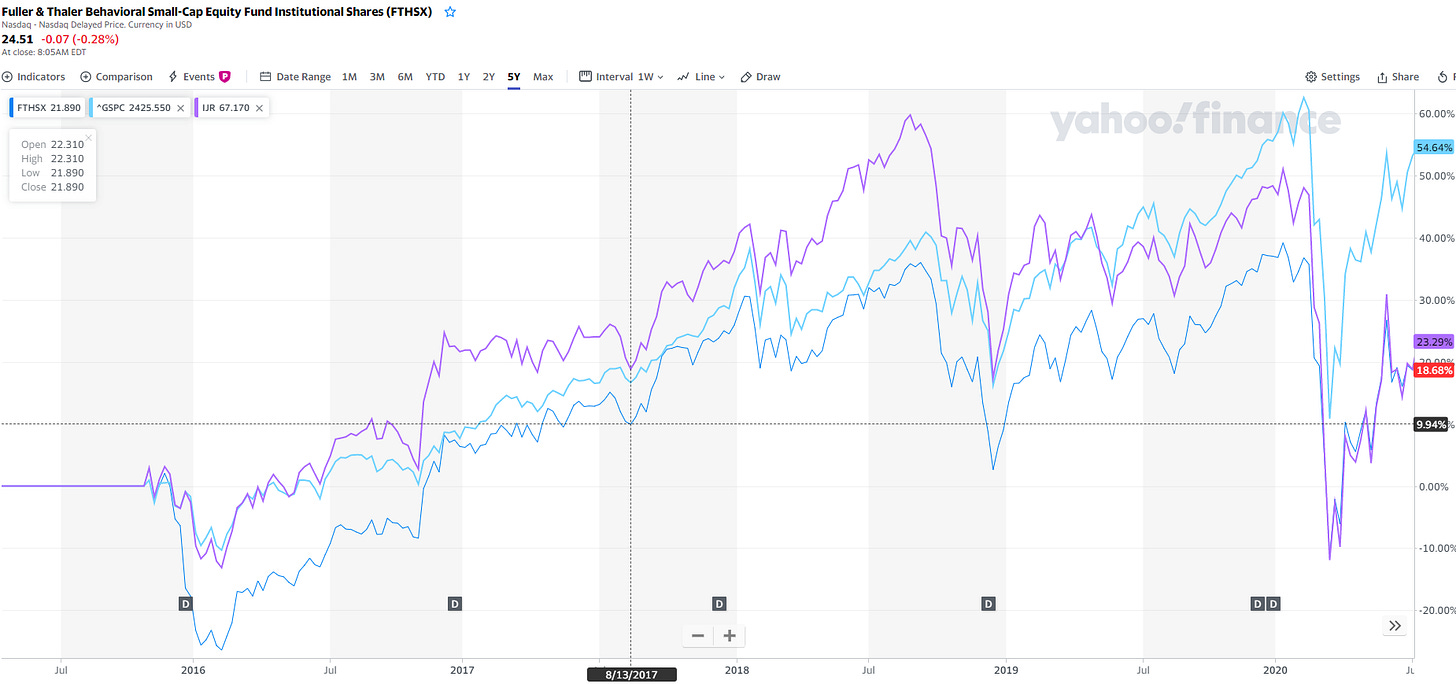

Thaler is a principal in Fuller & Thaler Asset Management Inc. that runs $6.1 billion in the small-cap Undiscovered Managers Behavioral Value Fund and $261 million in the Fuller & Thaler Behavioral Small-Cap Equity Fund.

After 5 years, these funds haven’t beaten a simple market-cap weighted small-cap ETF.

Fat-tails and Geometric Compounding

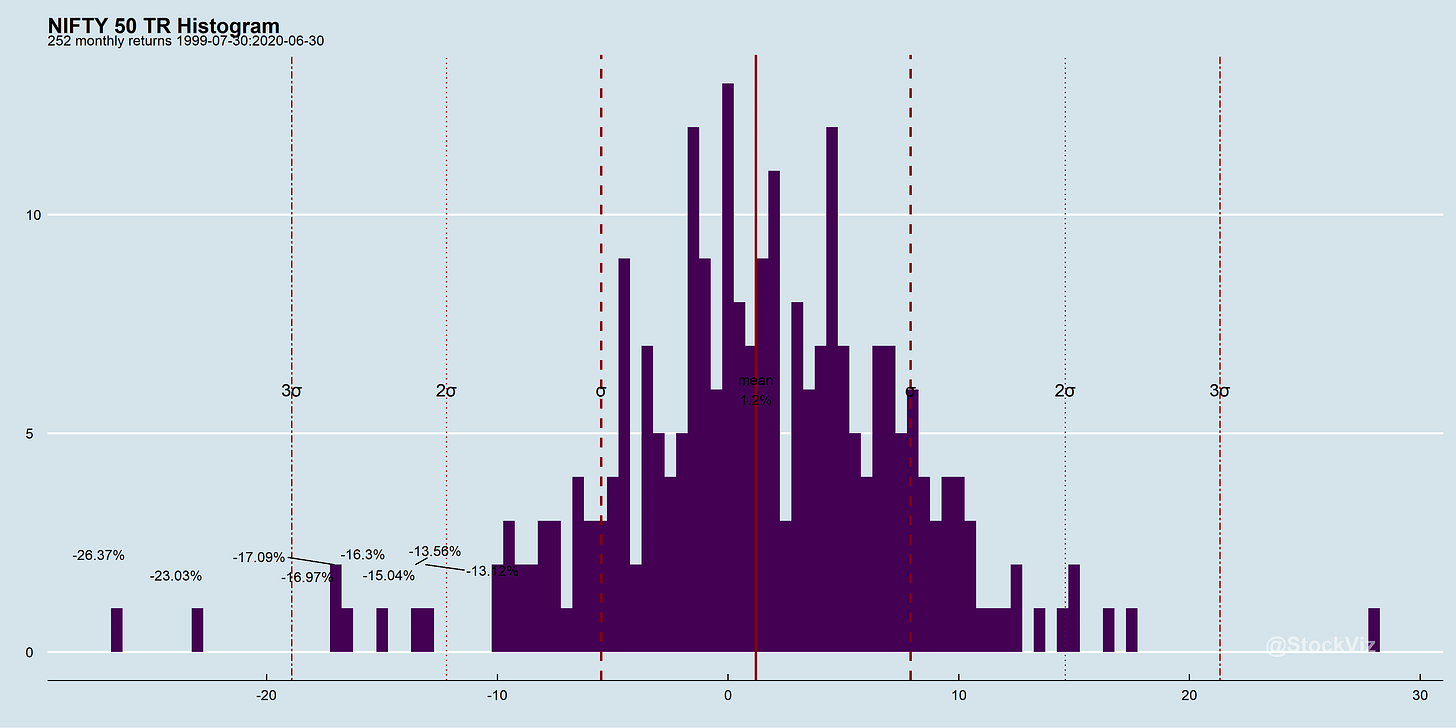

In the markets, it is entirely possible to lose years of returns in a single month. Low probability events with high severity can wipe out even the smartest investor.

Combine this with geometric compounding - a 50% loss requires a 100% gain from the bottom to bring the investor to break-even - and the preference to avoid losses doesn’t look that “irrational.”

The model, silly!

Perhaps, the problem is not with people but with the model being used to judge them. There is a big difference between tossing a hundred coins simultaneously and tossing them one after another. Behavioral economics uses a flawed model that treats them the same and labels us “irrational.” But, if you look at the world through the lens of non-ergodicity, actual investor behavior is not too far off the mark.

To make an economic decision, I want to know how my personal fortune grows or shrinks under different scenarios, not how the average person's fortune grows or shrinks.

I don't care that the average person "wins" at Russian Roulette, I care about what happens to me if I keep playing over time. Taylor Pearson

Conclusion

While the field of behavioral economics is interesting and it’s a good insight to how people behave in business and investing, one should ask themselves that if bad behavior is so pervasive, then (a) how come investing using that model has been a failure, and (b) if the model labels everything it sees as bad, then perhaps the model itself is wrong?