Close your eyes, think for a second you’re wealthy, which is nice, you can have the life you want. Then think what you’ll do with the money, sure first you’ll want the material things but then you’ll have a lot (hopefully) saved. Also this wealth you’ll like it to last for multiple generations. You might also want to do something good with it for perpetuity?

To do this, you’ll need an investment plan. A plan that looks at the total corpus, the expected annual additions to the corpus, withdrawals to meet expenses or philanthropic commitments and the growth which is investment return.

Shyam and I spoke about hedging last week, and we said that hedging with derivatives is not worth the trouble if your portfolio is less than a crore. Which is true, it’s better to have a equity and debt mix rather than complicate your life for little benefit.

However, what do you do if your portfolio is of considerable size? Further, you are looking to preserve and grow your wealth. Not just for the next 20 years but for far longer than that. What do you do?

Warren Buffet would say put it in an index fund and forget about it. The American economy will continue to grow and the stock market will follow it.

Which might be true, but if you have a large corpus, your goal might be to preserve and compound wealth at a reasonable rate. So how do you tackle this problem?

The Endowment Portfolio

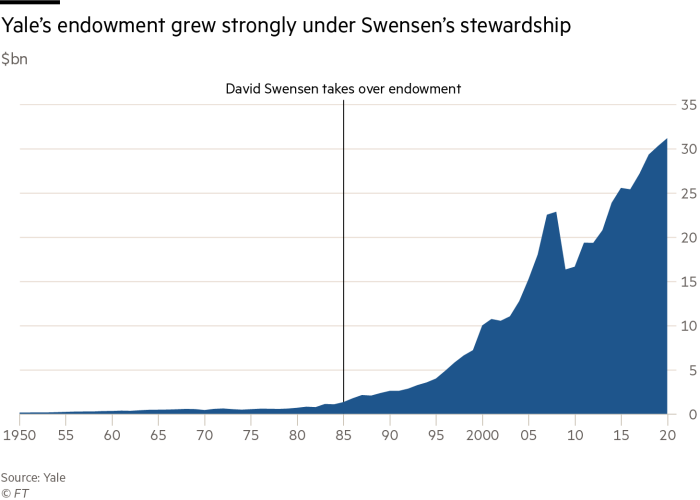

A few weeks ago David Swensen, the investment manager for Yale University Endowments, passed away. He had pioneered an approach that might be a sensible way for most families or institutions to invest in.

A wealthy family or institution like a a university have similar needs. Use a small percentage (4-5%) of the corpus to meet expenses and commitments and let the portfolio grow. And since your liquidity needs can easily met by allocating a small percentage to liquid assets, a large percentage of your portfolio can invested in things that the ordinary investor cannot.

The range of options get wider when you start considering : domestic equities, foreign equities, trading strategies, real estate, hedge funds, private equity, real assets, natural resources and direct businesses.

I have not mentioned assets that don’t create a direct yield or return. Like investing in apple orchard, generates yield through the produce but not cryptos. The idea is that the corpus is large, the source of returns and risk for a portfolio can be balanced by widening its holdings.

If you look at the Yale endowment portfolio, very little is invested in domestic US equities. The portfolio is balanced with low risk, fixed return allocations with highly uncertain long term horizon investments.

And this has happened over time.

You can say the portfolio has been looking for markets or investments which are often ignored because it does not fit into other investment mandates and provides an edge to an Institution like Yale that’s willing to look at these opportunities. It’s often these opportunities that can offer oversized returns without the risk of ‘multi-baggers’.

And if you are wondering how they have done, they have done well.

and it’s also grown considerably under this David Swensen’s stewardship

Can this be applied to you?

I think when someone thinks alternative investments, the first thought is wine or art and now cryptos but I think the first thing is not to speculate.

To frame an investment strategy that is built to generate returns in a dependable manner and allow the portfolio to grow.

So fixed income, commercial real estate, farmland and hedge funds/ trading strategies are expected to generate return consistently with less overall volatility. Though not always true and might not be liquid but they are meant to generate returns in a more consistent manner.

Then you have domestic and foreign equities, which are more volatile and but also liquid. Over a decent investment horizon, they should provide a high return that will compensate for the higher volatility.

And then you have, venture capital and private equity. Which requires a long investment horizon, its illiquid but if you select the right managers who know what they are doing it has the potential to generate outsized returns.

Think about it, like you need to target return to be generated with high certainty and the illiquid portion to deliver asymmetrical payoffs. But being overall less dependent on the market and short term sentiment and using your long horizon in your advantage by not thinking whether the market will go up or down.

Also remember the best investment opportunities are usually where no one is looking at. Startups, SAAS or even midcap stocks and the like are all known and unlikely to provide the diversification you might be seeking.

Looking for a sensible way to invest? Here’s how to get started.