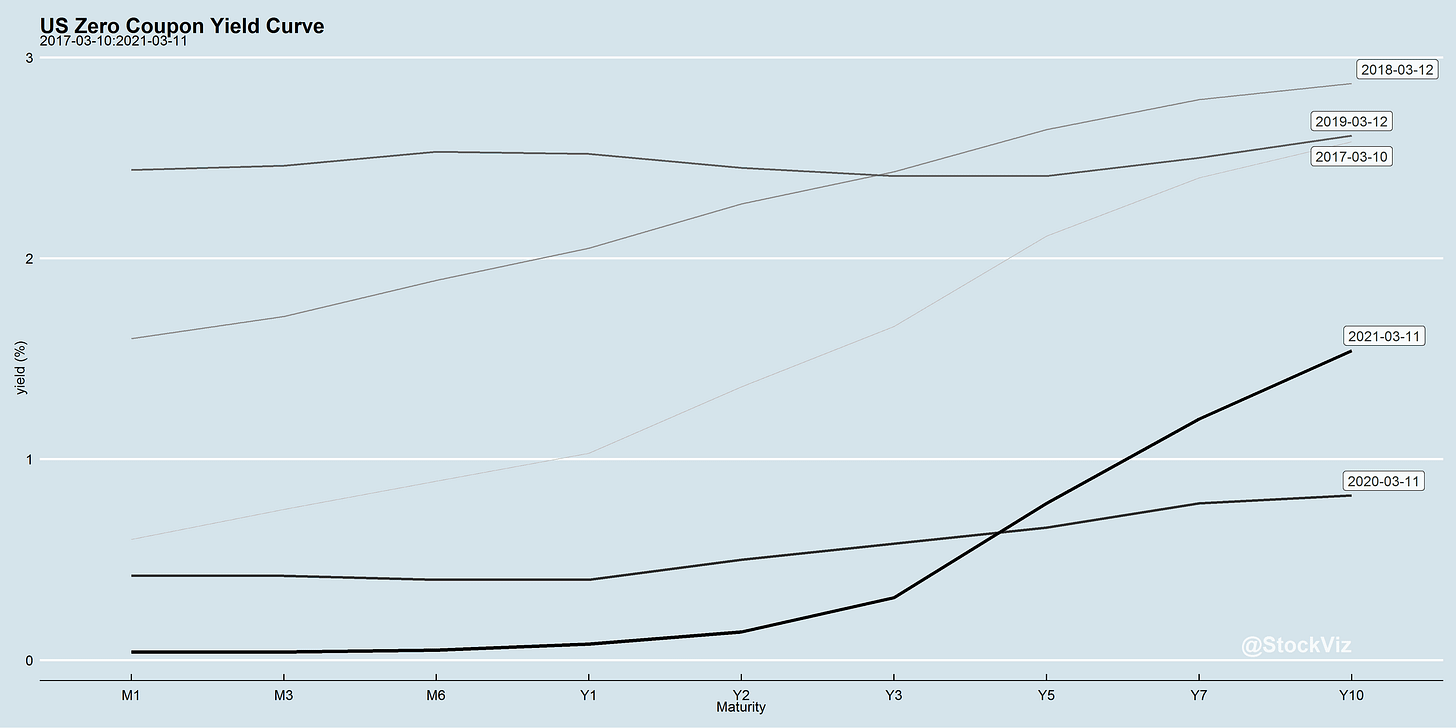

Bond yields during the height of the panic of Covid-19 fell to record lows and in the last few weeks have started to rise again. It is expected to continue to rise as economic recovery gets more stronger and vaccinations speed up. This is a good sign. So why has this been cited as the reason for the reason markets being volatile?

We try to get to declutter this and why bond yields need to be factored in as a near term risk for even Indian investors.

Search for Yield

The most important item over time in valuation is obviously interest rates, If interest rates are destined to be at very low levels. … It makes any stream of earnings from investments worth more money -Warren Buffett

Treasury yields affect most assets in the world either directly or indirectly, in terms of money flow, valuation and exchange rates.

In the last 10 years and last one year, markets have moved higher, stocks are trading at high P/E’s and one of the reasons that’s been justifiable is in the context of low interest rates. When large part of developed world’s sovereign debt trades at negative or zero interest rates, it pushes investors to other assets in search of yield. For example, a company like Nestle or Coca Cola or Apple, with strong balance sheets and long term visibility of stable earnings and growth potential, provides an alternative avenue to invest - you might get 1% in dividend yield and consistent capital appreciation over the long term.

Apart from capital flows, interest rates affect valuations, since stocks and real estates are valued on the basis of future cash flows discounted to the present. The first factor taken into account in the discount rate (the denominator) is the risk free rate which is usually the sovereign 10 year bond yield in your country. So for most US investors it is the 10 Year Treasury bonds and if you are an international investor it usually is US 10 Year Yield + Country Risk Premium based on Credit Rating+ Sector Risk Premium + Company Risk Premium.

So what happens is, all things remaining equal, a rise US 10 year yields , an asset’s valuation should fall because the discount rate is higher.

Also, low yields affect capital flows, they direct capital away from the US into other assets, emerging markets, private equity and even cryptocurrency in search of other high return opportunities and when US treasury yields rise, they usually direct capital back to the US.

This is interesting because US treasury yields are offering a better yield as much as 1% compared with Japan and Western Europe, this will direct some capital flows back to the US from rest of the developed world in search of risk free higher yields. These flows should strengthen the US dollar and threaten short term trading positions in other countries since the rise will reduce the total return in US dollar terms since the invested currency will depreciate.

And this brings us to an important factor.

Carry Trade

When investors borrow in a low rate currency such as Yen or Euro and US Dollar and invest in a higher yield currency like the Indian Rupee, the trade is meant to earn the interest rate differential between the two currencies. This is a very popular trade globally but it carries a big risk.

Since the interest rate differential is between 3-4% normally but exchange rates can be even more volatile. It’s kind of a head mentality thing because of strengthening of low yield currency and therefore expectation of depreciation in high yield currency, will push many traders involved in carry trade to unwind and this fear will spread thereby increasing the ferocity of this unwinding that will even push even emerging market equity investors to reduce their exposure.

That is why the Reserve Bank of India says that their goal when intervening in currency markets is not to determine the exchange rate value as much as its to control the volatility because increased volatility can have severe determinantal effect on markets and general economy.

Also if US yields continue to rise rapidly this risk is very real for the markets. This is the very thing that happened in 2013 during the ‘ Taper Tantrum’ that spooked the markets and caused a correction 20% in the Indian markets.

Inflation Expectations

The developed world has been living in a low interest world because of low inflation, which has allowed central banks to experiment with unconventional monetary tools to spur economic growth which has actually increased asset values.

Running large deficits have not mattered because inflation and interest rates have remained low. And now, what’s happened due to the pandemic is that countries have expanded fiscal stimulus significantly to support their economies. Till the pandemic, it was primarily monetary policy but fiscal action was limited. Fiscal stimulus is more direct since it puts money in the hands of people and the goal is for them to go spend and this actually is much more different than monetary tools which is meant for money to find its way into the way via bank lending.

And since fiscal stimulus is different and the latest round of 1.9 trillion fiscal stimulus by the US, it might end up putting demand pressure onto the economy, in an economy which is already showing signs of supply constraints.

Crude oil, industrial commodities such as copper and steel have increased significantly in the last few months. Further there have been supply constraints in things like semi-conductors and other materials.

So there is significant inflation pressures building in the global economy both on demand and supply side and that’s what the US yields are signaling. Right now the expectation is that inflation will spike up but it will be short term because of supply constraints and will come down to more normal levels.

However, if the expectations change and that the global economy recovery is much stronger, and inflation spike is more higher or sticky than expected, it might push US federal reserve to hike interest rates or unwind it’s easy monetary policy much quicker than expected.

It’s not the action but the unexpectedness of such action that spooks markets. That’s why the Federal Reserve wants to prepare the markets months in advance of any tightening, anything that will push the Fed to change course in a haste will send the markets into a panic.

On a longer course, if the demon of inflation returns to the developed world, which means it’s much higher than the current 2% target and it’s sticky, it would cause a major revision in valuation of markets and how markets will perceive budget deficits . That’s probably the biggest risk for the markets.

How should you react?

Every week there is a new situation in the market and risks are always around the corner, some become real and send the markets into a tizzy, others the markets just digest uncomfortably perhaps but still move ahead and few just fade away.

The risk of yields going even higher does exist but it’s also likely that economic recovery this year will be very strong. With India growing in double digits, US at 6-7%, the global economy it seems will have a great year. And interest rates still low, it makes sense to be still invested majorly in equity markets.

But it might not be a good to invest with leverage or be highly invested in highly risky speculative stocks, those are never good ideas but especially now, those should be avoided.

Also it might be a good idea to have some dry powder, if markets correct, it might be a good idea to deploy it then, since the economic forecasts will be still robust.

Check out completely automated direct-equity advisory: freefloat.in

Investing in the US? We got you covered on freefloat.us

Related: Secular turning point in inflation?

If the 10 year yield goes up, what are the sellers doing with their cash? They are not buying stocks. They are not buying even riskier emerging markets. Cryptocurrencies are too small to absorb these levels of sell offs. Are they going into the shorter end of the yield curve? https://ycharts.com/indicators/10_2_year_treasury_yield_spread ?