Most market participants, that includes Shyam and I, have been confounded by the market’s resilience the past few weeks despite the despair around us. The human tragedy is staggering but also there is an economic angle to this, which the markets seem to have shrugged.

The Indian equity markets are not cheap, they are trading at historically high levels, currently projecting ~20% growth in earnings for current financial year, which is sure to be corrected downwards. And with the government and central bank so far being reluctant to provide economic and financial support like last time, the economic pain might be prolongated resulting in the earnings correction downward that will be significant.

It also won’t be the first time, the last few years the earnings growth expectation and actuals have diverged significantly.

But the markets have held up and so this week we try to decipher this puzzle.

Index Constituents.

When media or most people talk about the market, they mention the Sensex or nifty has gone up or down this much from the perspective of what these indices constitute.

From a layman perspective, we know now that IT, consumer goods, pharma and telecom are relatively less affected or even benefit from the current situation. That’s about 1/3rd of the index.

Let’s see how different sectors and market segment have performed the last month.

The biggest gainer is metals because of the boom in commodities that’s underway globally. Followed by pharma, which is expected but everything else is not. IT is down but surprisingly, Nifty Midcap and Smallcap are significantly higher this month which is surprising. You have not seen sector rotation into defensives or less risk taking that we would have seen normally with an economic contraction.

What about fund flows?

There was huge inflows from foreign investors in the past few months, about 200,000 crores in rupees or 27 billion dollars. Which is significant which pushed the markets to their all time highs. While about 12,000 crores has exited the last month, it’s not made much of a difference because domestic fund flows have been robust this time around.

While on 12th April 2021, the markets fell 4% and the FII sell number was at it highest point on that day for the month. However, that intensity of selling has not been followed through that would have indicate panic selling or massive unwinding which has helped markets to hold up.

Second wave in UK and US

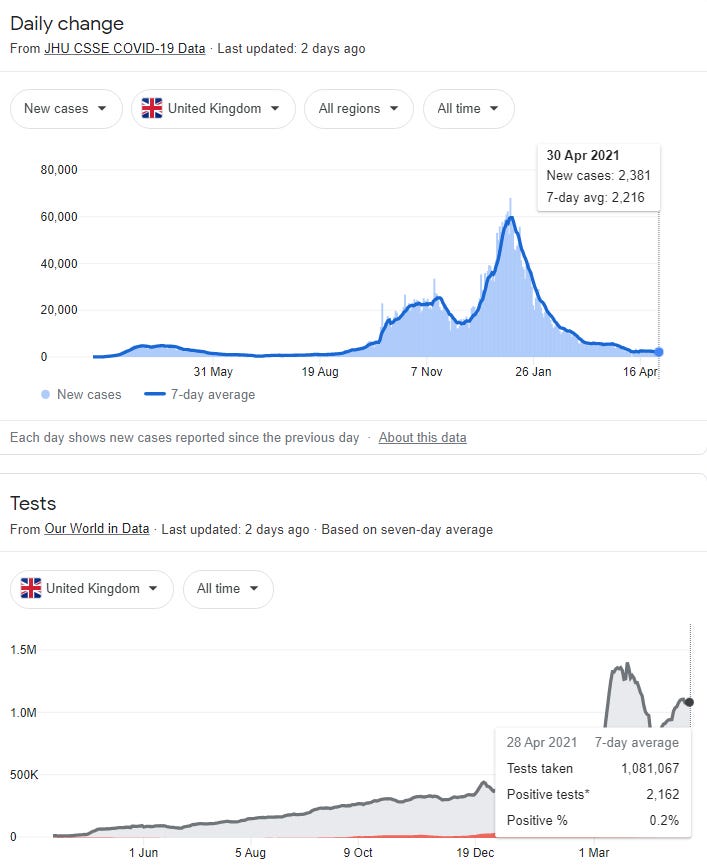

This might be also due to the experience of the second wave in the US, UK and Europe. Those Markets did not correct when their regions experienced as bad as India’s second wave between October 2020 - February 2021. Also we must know that some parts of Europe are still in some form of lockdown but the markets have been holding up.

This might be due to the unprecedented fiscal and monetary stimulus to support economies, which one could argue led to inflated asset prices.

But also partly of the vaccine test results trials started coming out and markets understood that pandemic now has a real exit strategy and it’s matter of time.

Visible Exit

UK though not as bad as India had a terrible second wave, which has been brought under control through lockdowns and vaccine rollouts.

It’s interesting to see that UK has achieved low new Covid cases by vaccinating only 21% of their population fully and 51% with a single dose. The stringent lockdowns in December and January did play a role but so have vaccines.

Is the market thinking to cover one shot to half of its population, it would take 6-8 months for us a similar situation as UK.

And the local lockdowns and vaccinating the most urban centers sooner will provide respite in the next few weeks for things to return to some kind of normalcy.

Is the market this as a short term pain that we’ll have to endure and it won’t last beyond 2021? Perhaps.

But I also think that right now they are multitude of factors from higher retail participation to ample global liquidity and weakness of dollar have contributed to most asset classes remaining at inflated levels.

Risks

Markets are dynamic and it’s always changing and just because the markets have held up, does not mean it will continue to do so, some of the reasons can be:

Significant downward revisions to the economy, fiscal situation and company earnings.

Negative Covid news such as variants being immune to the vaccine.

Inflation.

Social upheaval leading to political or policy instability due to economic and health widespread distress.

Fund outflows.

Other ‘known unknown’ factors

How do you play it?

You don't. Try to stick to a disciplined approach where you follow a predetermined strategy, even if you think you might lose money in the short run but over the longer term, you'll even up and do much better by going by your biases.

No one predicted that markets would go up 100% from their lows of March 2020.

It's hard to predict what the market will do, so it's better not to do it.

Looking for a sensible way to invest? Here’s how to get started.